What Is a Gamma Squeeze Vs Short Squeeze

When stock prices change drastically, the environment could be favorable for a squeeze. In this case, stockholders can find themselves purchasing or selling outside of their usual trading routine in order to limit losses. An extreme case of this is a “gamma squeeze,” in which investor buying activity drives a stock’s price up, frequently fairly dramatically. Find more information about gamma squeeze and how gamma squeeze works in this article.

What Is a Gamma Squeeze in the Stock Market?

Gamma Squeeze is a characteristic of the derivatives markets because it is a component of trading in options. Gamma squeeze serves the purpose of assisting makers who have sold call options on a certain stock to hed their exposure to negative (short) gamma and negative (short) delta.

The price of the underlying shares rises as market participants buy or sell out of their positions. Gamma squeeze is the term for this.

- The term “delta” refers to the anticipated change in an option’s price in response to a $1 change in the value of the underlying stock. Because the option’s price would increase in tandem with an increase in stock price (delta), a positive delta denotes a long position in the market, while a negative delta denotes a short position.

- Gamma, which simply refers to the rate of change of the delta, is the first derivative of the delta. Its values are highest for options that are ATM (at the money), and lowest for those that are distant OTM or ITM (in the money).

Widespread speculation about the potential direction of a stock’s price can lead to a gamma squeeze. In addition, a number of significant donors to the phenomenon include:

- Short-dated call options on a stock

- Delta hedging

- Shares with low liquidity

What Is a Gamma Squeeze vs Short Squeeze? The Differences

A short squeeze is comparable to a gamma squeeze. A gamma squeeze, in contrast to a short squeeze, is initiated by the market maker rather than a trader.

Gamma Squeeze

The major reasons for a gamma squeeze are unpredictable price movements and excessive trading volumes that compel market makers to close out their holdings. The gamma squeeze will likely result in a large quantity of trade, which could raise the price.

For instance, you might have good ratings on Gamestop. The stock is trading at $30 when you decide to buy $50 calls that expire in a month. You are being sold the possibilities that you choose. Frequently, the party on the other side of the transaction is a market maker.

Short Squeeze

Similar to a gamma squeeze, a short squeeze affects traders rather than market makers. Similar situations where there is a sharp market movement brought on by high trade volume in a certain direction can result in traders being forced out of their positions.

I take the automobile to the neighborhood dealer and sell it for $75,000 there.

The cost of the vehicle is reduced to $50,000 six months later. I return the car for $50,000 and deliver the keys to your home. I end up keeping $10,000 in profit after paying your $15,000 rental cost ($2,500 x 6).

Gamma squeezes: How Do They Operate in Stock Trading?

Gamma squeeze can cause spikes and clips in the stock price while the squeeze takes place. This squeeze frequently corrects itself, although it might provide traders short-term trouble.

Following some significant company-related news that leads the markets to behave irrationally in either way, a gamma squeeze frequently occurs. This behavior leads to extreme short-term volatility, which causes the squeeze to happen.

How Long Does a Gamma Squeeze Last?

It’s crucial to schedule your investments properly because a gamma squeeze can persist for days, weeks, or even longer. The last thing you want is to experience a gamma squeeze when you are forced to purchase high and sell cheap.

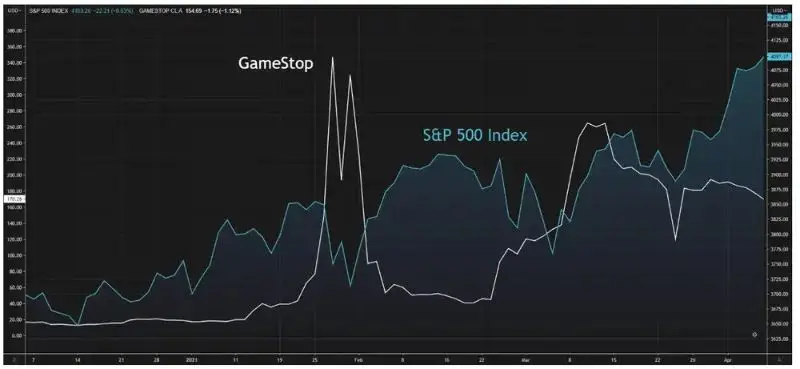

It’s also not a straight line; both AMC and GameStop had significant price surges followed by sharp price declines. This left a lot of investors holding the short end of the stick, but it has occurred before.

What Happens During a Gamma Squeeze?

A gamma squeeze happens, as mentioned when stock prices rise and force investors to adjust their stock positions. The squeeze can occur when there is a significant increase in the buying of short-dated call options on a single company, which causes a sharp price increase. This may prompt investors to purchase further calls, driving up stock prices even further.

Example of Gamma Squeeze

The GameStop (GME) spectacle, which recently garnered headlines after a spectacular increase in its share price over a relatively short period of time. Investors require a counterparty in order to buy call options on the GME. On the other side of the trade, the market maker (counterparty) typically adopts this position.

Market makers typically don’t care about changes in the price of the underlying stock because they make money on the deal itself (spread). Therefore, should the price of the underlying stock increase, adding more long calls entails risk for the market maker. Market makers visit the market and buy the relevant stake in order to protect themselves from such unfavorable fluctuations.

How to Spot a Gamma Squeeze

Only unusual events often result in a gamma squeeze. Usually, it’s because a wealthy individual or group wants to take over a business, but in the case of Reddit’s surge, they were seeking stocks that were highly shorted.

The Bottom Line

Beyond gamma squeezes, other factors can have an impact on stocks. This suggests that significant increases higher in stock prices can happen without a gamma squeeze and that strong moves higher won’t always follow a gamma squeeze.

Article Source: https://libraryoftrader.net/what-is-a-gamma-squeeze-vs-short-squeeze

More Social:

https://libraryoftradernet.weebly.com/blog/what-is-a-gamma-squeeze-vs-short-squeeze

https://sites.google.com/view/libraryoftrader/blogs/what-is-a-gamma-squeeze-vs-short-squeeze

https://docs.google.com/presentation/d/1Xx2H_JPIK6MBUK2eHfYvz0sFWSZ-tPm8Ztxeg-oS_Fc/edit?usp=sharing

https://docs.google.com/forms/d/1juCSDEncP5NAYQ5iJ3c2MZMj1x_mAlC4EC0egu3AvKM